The Secret Of Gold Prices

페이지 정보

본문

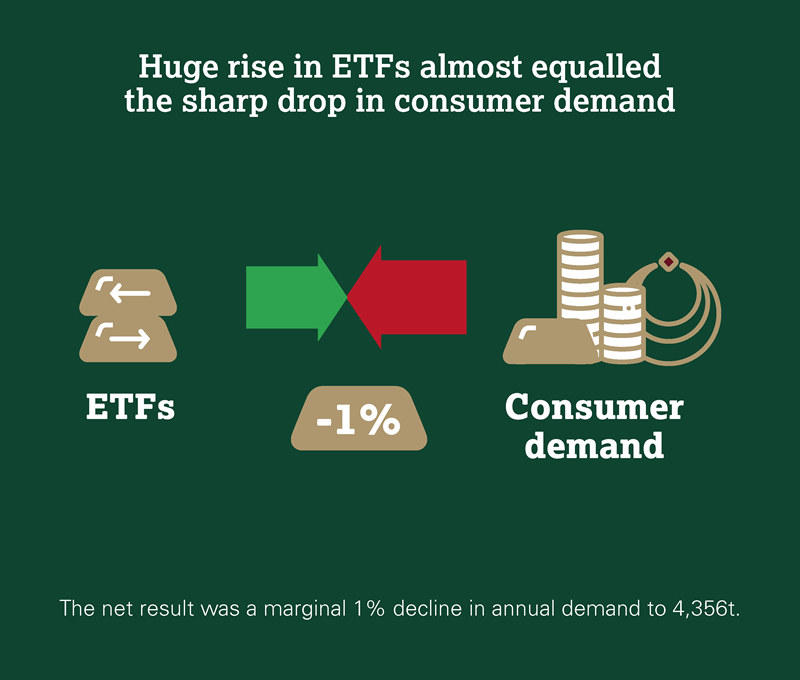

If the Fed leans against the big deficits with charge hikes, this will cause a stronger dollar and result in a world liquidity crisis in rising markets. Whether you might be shopping for the Indian gold ring for someone or as a deal with for your self, understanding more about the golds "rings" will help in making certain that your venture is profitable. Monetary risk is high because the policy response of the Federal Reserve, the ECB, the Bank of England, the BOJ and the vast majority of central banks to the risks mentioned above continues to be ultra-unfastened monetary insurance policies, zero curiosity price insurance policies (ZIRP), negative interest fee policies (NIRP), the printing and digital creation of a tsunami of currency and the debasement of paper and electronic currencies.Should the macroeconomic, systemic and geopolitical dangers enhance even further in the coming months, then the central banks’ response will seemingly again be more low cost money insurance policies. In 2016 gold demand has been supported by stellar ETF demand as, according to the World Gold Council, the high gold value in Q3 had a destructive affect on gold demand, pinetree.sg elsewhere. Although this is less the case now given ultra free zero p.c and detrimental interest price monetary insurance policies. Other than Trump’s disastrous spending policies and strategic gold patrons dumping the metal for equities, there are some highlights to think about in the next few months.

While tensions with Russia could subside with the Trump election, tensions with Iran and other Muslim nations look set to worsen.Indeed Trump’s trade and economic insurance policies have the potential to create significant tensions even with main trading companions in the EU and with China. Issues with banks, a la Lehman or Deutsche, or a major terrorist incident or another warfare might badly impact fragile shopper and investor sentiment. The move by Druckenmiller noticed gold proceed to decline in the next days thanks to a change in sentiment. Based on sentiment and momentum, gold ought to have held these good points. Does this imply that gold goes to underperform or worse, enter a bear market in the following four years? Several other international locations are gearing up too, as religion in the US dollar is going down. When economies are experiencing instability or uncertainty, akin to during times of recession or geopolitical tensions, traders are likely to flock towards assets perceived as protected havens, together with gold.

While this is an economically enticing apply, taking part in off economies of scale to make the crop more worthwhile for the farmer, it might probably have severe environmental drawbacks. Giving the divisions freer reign meant that people close to retail gross sales would have extra say in mapping coverage. We define below just some of the elements which have result in the recent declines in the gold worth, and outline why we don’t think that is an indication of things to come back. Gold Price: $1,722.28. News: Gold struggles for course as traders deal with ECB, Jerome Powell. News: LBMA Annual Precious Metals Forecast Survey. Those searching for to allocate funds to precious metals should geometrically worth value common into place by front loading their preliminary allocation and allocating as much of 50% of their allocation to gold on the primary transaction. The price of gold is showing as whether it is set up for an additional bull run. Media estimates said a chunk of sashimi (sliced raw fish) from this specimen would run about $40. Both Brexit and the Trump victory have incorrect footed the financial markets and we're heading into unchartered territory each politically and economically. "Gold prices surged late on Nov. 8 and into the early morning hours of Nov. 9 as a Trump victory grew to become clear.

It’s extremely unlikely Trump goes to be forcing Janet Yellen to announce a return to the gold commonplace, however we might effectively see extra discussion about gold’s financial position. U.S. dollar is likely to drive the price of gold higher via increasing demand (as a result of more gold could be purchased when the dollar is weaker). Yellow and rose gold are inclined to have the identical worth. Recently, there was constant soar in the demand for gold in Chennai. After very significant demand and the value surge in Q1 and Q2, Q3 saw a discount in demand for jewellery and coins and bars. Both jewellery and gold bars and coin gross sales have reached ranges this yr not seen since 2009. But bodily demand has not mirrored such ranges in Q3. As we outlined last week, the Sharia Gold Standard or Islamic Gold Standard is about to be introduced, this can permit Muslims around the globe to put money into physical gold.

It’s extremely unlikely Trump goes to be forcing Janet Yellen to announce a return to the gold commonplace, however we might effectively see extra discussion about gold’s financial position. U.S. dollar is likely to drive the price of gold higher via increasing demand (as a result of more gold could be purchased when the dollar is weaker). Yellow and rose gold are inclined to have the identical worth. Recently, there was constant soar in the demand for gold in Chennai. After very significant demand and the value surge in Q1 and Q2, Q3 saw a discount in demand for jewellery and coins and bars. Both jewellery and gold bars and coin gross sales have reached ranges this yr not seen since 2009. But bodily demand has not mirrored such ranges in Q3. As we outlined last week, the Sharia Gold Standard or Islamic Gold Standard is about to be introduced, this can permit Muslims around the globe to put money into physical gold.

- 이전글인스타 계정 구매 사이트 24.12.08

- 다음글The Most Inspirational Sources Of Espresso Maker 24.12.08

댓글목록

등록된 댓글이 없습니다.

블로그체험단 바로가기

블로그체험단 바로가기